Jan 3, 2025

Sunk Cost Fallacy: Understanding the Psychological Trap

Introduction

Have you ever found yourself sticking with a decision simply because you’ve already invested time, money, or effort into it? This is a common dilemma known as the sunk cost fallacy. It influences how we make decisions every day, whether we realize it or not. Let's explore this concept through relatable stories and psychological insights.

Jimmy's story

Meet Jimmy, a local fisherman who sells his catch at the market. He knows that he can only sell fresh fish. So, when he catches fish that are spoiled, he throws them away without a second thought. To him, these bad fish represent sunk costs—money and time spent that can’t be recovered. Instead of dwelling on the loss, he focuses on selling fresh fish that his customers want.

But Jimmy's rationality doesn't always carry over into his personal life. One afternoon, he buys a ticket to a movie. A few hours before the show, his friends invite him to play football, his favorite sport. Despite wanting to join them, Jimmy declines because he has already spent money on the ticket. According to the sunk cost theory, he shouldn’t have let the ticket dictate his choice. The money is gone, and what's important is enjoying his time with friends.

Sunk cost fallacy

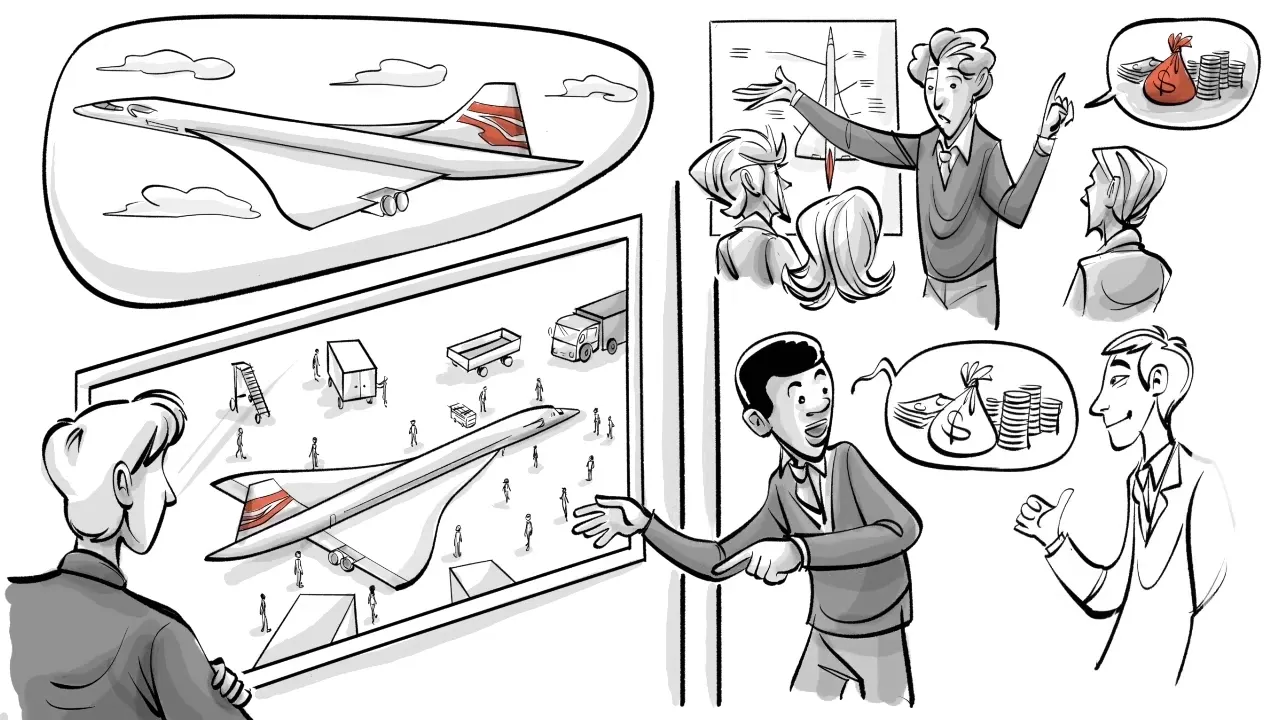

The sunk cost fallacy is the tendency to continue an endeavor once an investment in money, effort, or time has been made, regardless of the current costs or benefits. For example, the British and French governments continued funding the Concorde, a supersonic passenger plane, even when it became clear that the project wouldn’t yield economic benefits. They were trapped by their past investments, unable to let go.

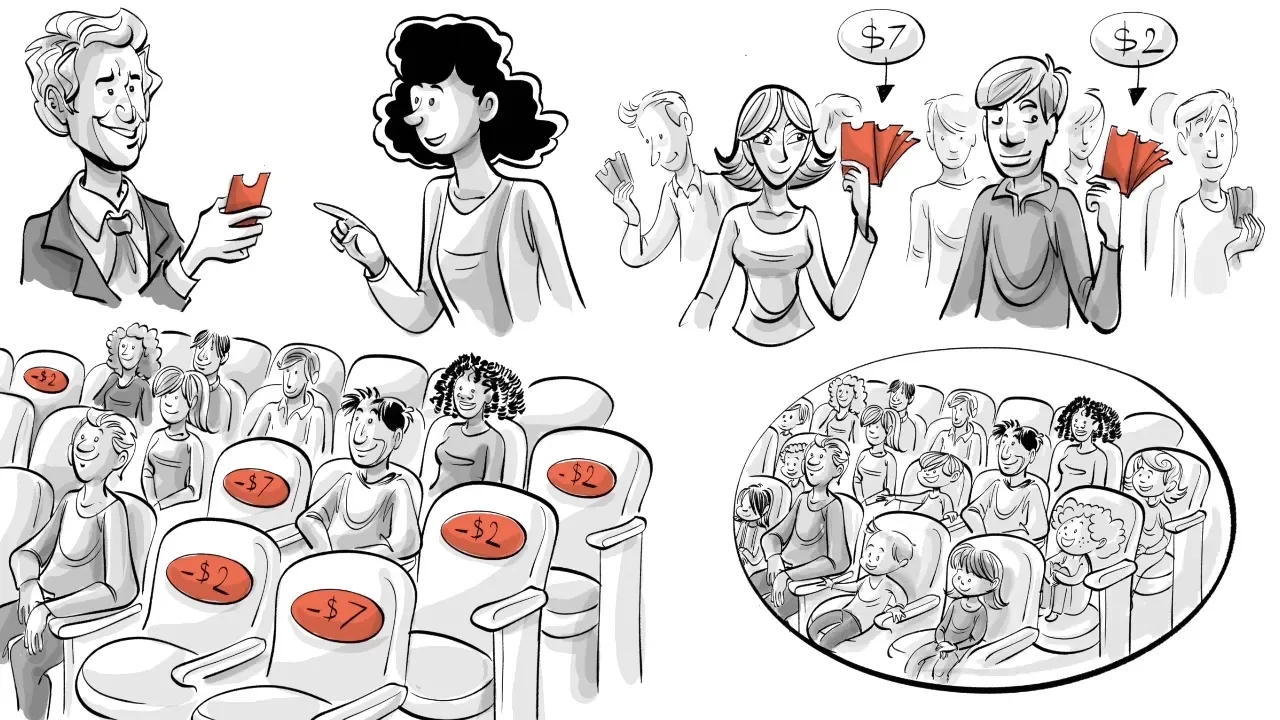

Experiment by Hal Arkes & Catherine Blumer

To better understand this fallacy, economists Hal Arkes and Catherine Blumer conducted an experiment involving theater season tickets. The regular price was $15, but some participants received discounts of $7 or $2. It was found that those who paid the full price attended more plays than those who received discounts. Interestingly, children under six were the only ones who behaved rationally, highlighting how this fallacy affects adults more than children.

3 psychological reasons behind this behavior

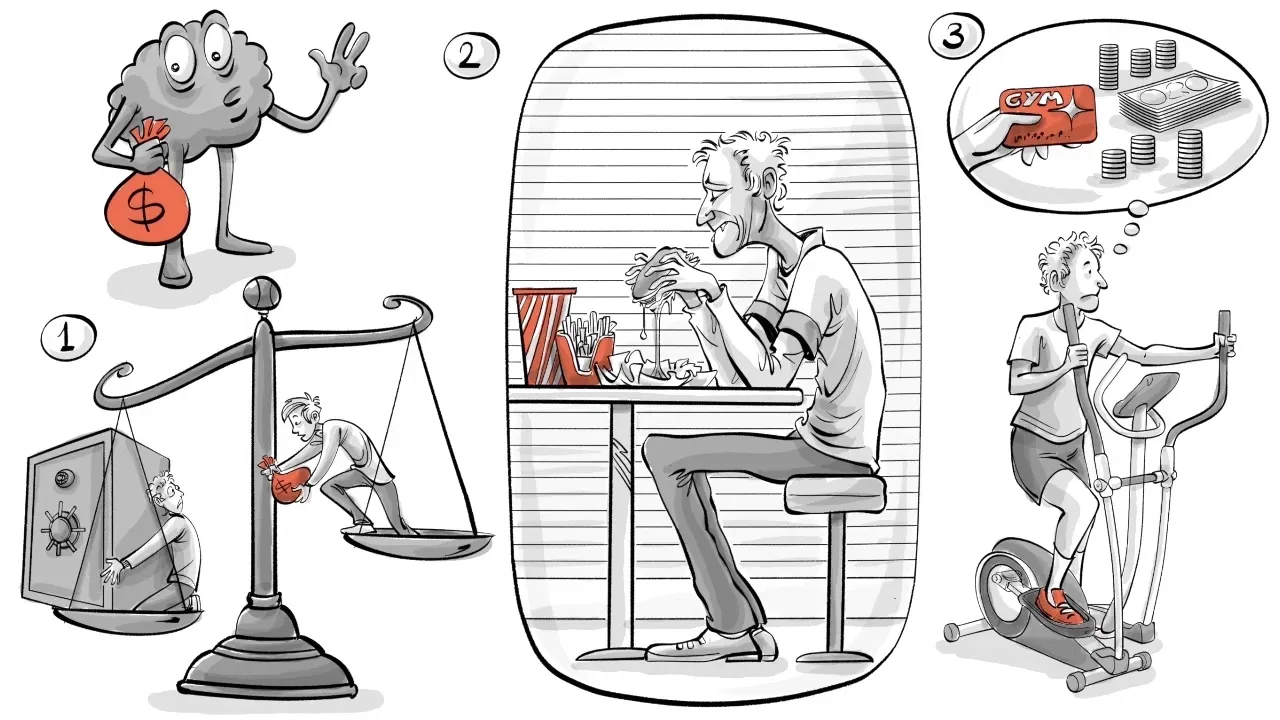

There are three key psychological reasons that contribute to the sunk cost fallacy:

- Loss aversion: People prefer avoiding losses rather than acquiring equivalent gains. For instance, many would avoid a bet where they could win $50 if there’s a chance they could also lose $50.

- The desire not to appear wasteful: This is why some people finish their meals even when they feel full or dislike the taste of the food.

- To ensure we do things we fear we otherwise wouldn’t: For example, buying a costly gym membership to motivate oneself to actually go and work out.

What was your experience

Now, let’s reflect. Assuming you're not caught in the Concorde fallacy, what would you do differently if you could ignore all past investments in your education or career? Can you identify any 'sunk costs' that might be holding you back from making necessary changes in your life? Recognizing these costs is the first step to overcoming the fallacy.

Conclusion

The sunk cost fallacy is an insidious trap that can lead us to make suboptimal decisions. By understanding it, we can become more mindful of our choices. Remember, just like Jimmy, it's important to focus on what truly matters—our present and future happiness, rather than being anchored to past investments.

This article was created from the video Sunk Cost Fallacy: Not Knowing When It’s Time to Stop with the help of AI. It was reviewed and edited by a human.